UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| ☑ Filed by the Registrant |  | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR THE USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to Rule 14a-12 |

ITT Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

2018

2020

Notice of Annual Meeting

& Proxy Statement

ITT Inc.

ITT Inc.

1133 Westchester Avenue

White Plains, NY 10604

DEARFELLOW

SHAREHOLDER

| |

FRANK T. MACINNIS

CHAIRMAN OF THE BOARD

April 9, 2018March 31, 2020

On behalf of the ITT Inc. Board of Directors, and executive officers, it isthank you for your continued investment in ITT. The Company delivered another year of exceptional performance in 2019 as our pleasurefocused strategy continues to produce long-term results for our shareholders. We invite you to join us at our 20182020 Annual Meeting of Shareholders on Wednesday, May 23, 201815, 2020 at 9:00 a.m. Eastern Time in White Plains, New York. Details regarding admission to the meeting and the business to be conducted are provided in the accompanying Notice of Annual Meeting and Proxy Statement.

At ITT, we are committedBOARD COMPOSITION & REFRESHMENT

It has been an honor to fostering sound corporate governance. You’ll see thatserve as ITT’s independent Chair since 2011. As mentioned last year, I plan to retire at this year’s Annual Meeting as part of a leadership transition strategy in connection with the appointment of Luca Savi as CEO in January 2019. In December 2019, the Board appointed Richard Lavin to serve as ITT’s next independent Chair effective with my retirement.

Rich has served as a director of the Company since 2013, and as Chair of the Board’s Compensation and Personnel Committee since 2017. His deep global manufacturing operations expertise includes a 30-year career with Caterpillar, Inc., extensive international expertise, and legal and human resources experience. This background has allowed him to provide support to our attached 2018 Proxy Statement reflectsmanagement team as they drive a high-impact strategy, and as Chair he will be in a position to help guide ITT’s strategies for growth and profitability going forward.

We remain thoughtful about our continuedBoard composition and effectiveness both through our formal, annual Board and committee evaluation process as well as through our director nominations process. Our deliberate focus on deliveringrefreshment has allowed us to build a Board that reflects a diversity of skills, experiences, and backgrounds.

SUCCESSFUL CEO TRANSITION

This past year, we completed a seamless CEO succession process and Luca successfully led ITT to another year of strong performance,financial and operational performance. The Board has provided strong, independent oversight of the business strategy through the transition, and has worked closely with Luca and the management team to focus on cultivating an engagedinnovative, diverse and effective Board of Directors, maintaining regular dialogueinclusive workplace that engages and energizes our employees.

SHAREHOLDER ENGAGEMENT

Shareholder engagement remains a key priority for the Board. The valuable feedback and perspectives received through discussions with our shareholders and advancing transparent corporate governance practices.

2017 Performance:Throughout 2017, we drove activities across the enterprisehelp to optimize execution while advancing our essential long-term growth strategies.inform ongoing boardroom discussions. We continued to growour annual outreach and engagement efforts in our key end markets including automotive, rail and general industrial. Our team also won significant new business including additional automotive platform wins in China, a new multi-million dollar rotorcraft platform and a record defense vehicle award for our shock absorber business. These multi-year awards — and others like them — are accelerating our forward momentum in exciting markets that will help drive our future growth. This performance drove strong returns for our shareholders, delivering a 40 percent total shareholder return in 2017.

Shareholder Engagement:Our Board is committed to2019, engaging with our shareholders and thoughtfully considering their feedback and insights. In 2017, we enhanced our established investor outreach program by undertaking a significant shareholder engagement effort, which resulted in

our reaching out to investorscollectively representing over 50 percentapproximately 43% of our outstanding shares. These discussions covered a wide range of topics includingcentered on our businessBoard composition and financial results, corporate governance,leadership transition, our executive compensation program andpractices as well as our enhanced sustainability initiatives. The feedback we received was shared withreporting. Shareholders were particularly interested in discussing our full Board of Directors and is being actively incorporated into our go-forward plans. We look forward to continuing this valuable dialoguefirst-ever Sustainability Report published in 2018 and beyond.2019.

Board Contributions To Our Success:In addition to reviewing and providing guidance on the Company’s strategic plan, our directors are committed to continually developing a deeper understanding of our people and workplaces. In 2017, the Board visited our recently acquired Wolverine Advanced Materials site in Virginia, where they had an opportunity to meet employees throughout the business and tour the facility. We also continued our commitment to best practices in corporate governance by evaluating all of our committees and rotating our Compensation and Personnel Committee and Nominating and Governance Committee chairs, continuing our commitment to effective board refreshment and proactive board succession planning.

Fostering Employee Engagement:In 2017, we continued our commitment to shaping a healthy and high-performing culture, defined by our Purpose of “We Solve It” and our Principles of Impeccable Character, Bold Thinking and Collective Know-how. We also advanced our efforts around employee engagement to energize our teams and help them better understand their role in driving innovation, growth and performance. This work is accompanied by our long-term focus on emphasizing that “how” our achievements are attained is just as important as “what” we accomplish. We believe that our commitment to employee engagement is a true competitive advantage and a key differentiator when growing our existing talent, recruiting new talent and partnering with our customers and other stakeholders.

On behalf of our Board of Directors, weAgain, I thank you for your investmentcontinued support and confidence in ITT and your continued support. Wethank you for the nearly 19 years that I have had the privilege to serve on this Board. I feel honored to have worked with so many deeply talented people at ITT and look forward to welcomingthe Company’s continued success.

Thank you for your continued support and confidence in ITT. We hope you can join us at our 2018the Annual Meeting of Shareholders.

Meeting.

Sincerely,

DENISE L. RAMOS

FRANK T. MACINNIS

NOTICEOF 20182020 ANNUAL

MEETING OF SHAREHOLDERS

MEETING INFORMATION

FRIDAY, MAY 15, 2020

WEDNESDAY, MAY 23, 2018

9:00 a.m. Eastern Time

ITT Inc.

1133 Westchester Avenue

White Plains, NY 10604

ITEMS OF BUSINESS

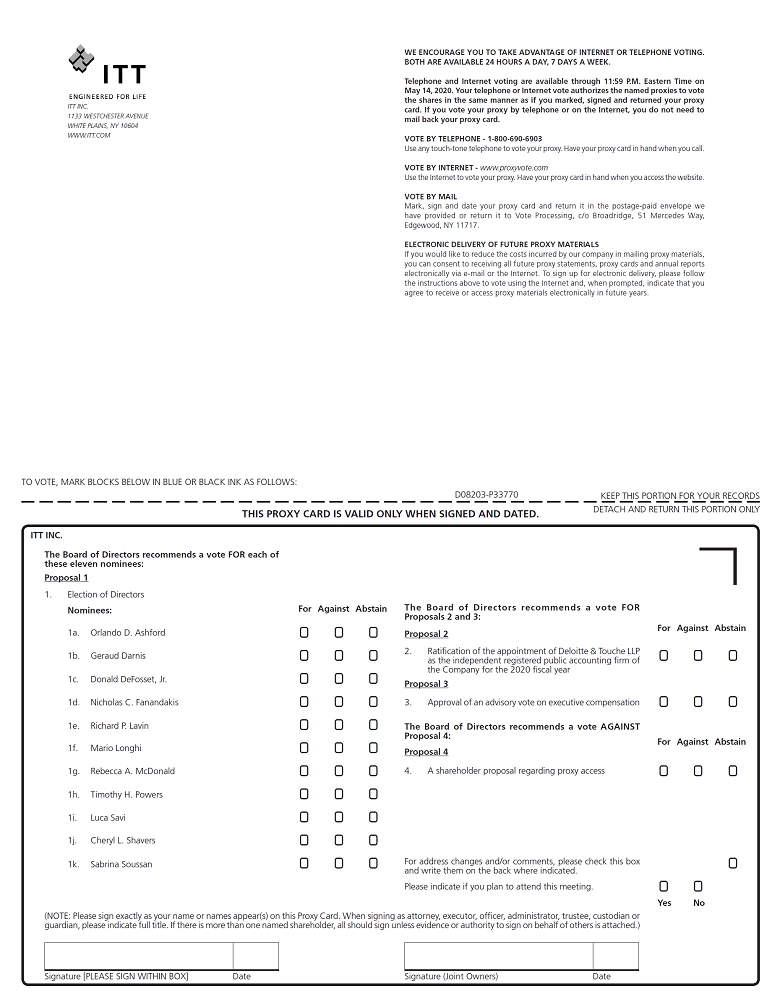

1. To elect the 11 nominees named in the attached Proxy Statement to the Board of Directors to serve until the 2021 annual meeting of shareholders or until their respective successors shall have been duly elected and qualified.

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2020 fiscal year.

3. To conduct an advisory vote on the compensation of the Company’s named executive officers.

4. To consider a shareholder proposal, if properly presented at the Annual Meeting.

5. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

WHO CAN VOTE, RECORD DATE

Holders of record of ITT Inc. common stock at the close of business on March 26, 201818, 2020 are entitled to vote at the Annual Meeting and any adjournmentsadjournment or postponementspostponement thereof.

MAILING OR AVAILABILITY DATE

Beginning on or about April 9, 2018,March 31, 2020, this Notice of 20182020 Annual Meeting of Shareholders and the attached Proxy Statement are being mailed or made available, as the case may be, to shareholders of record on March 26, 2018.18, 2020.

ABOUT PROXY VOTING

It is important that your shares be represented and voted at the Annual Meeting. If you are a registered shareholder, you may vote online atwww.proxyvote.com,, by telephone or by mailing a proxy card. You may also vote in person at the Annual Meeting. If you hold shares through a bank, broker or other institution, you may vote your shares by any method specified on the voting instruction form that they provide. See details under “How do I vote?” under “Additional Information“Information about Proxy Statement and Voting.” We encourage you to vote your shares as soon as possible.

By order of the Board of Directors,

LORI B. MARINOMARY BETH GUSTAFSSON

Senior Vice President, General

Counsel and Corporate Secretary

April 9, 2018

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:March 31, 2020

|  |  |  | ||||||

|  |  |  | ||||||

ONLINE | |||||||||

Visit the website on your proxy card | BY MAIL Sign, date and return your proxy card in the enclosed envelope | BY PHONE Call the telephone number on your proxy card | IN PERSON Attend the Annual Meeting in White Plains, NY See page | ||||||

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. | |||||||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR ITT Inc.’s Annual Meeting of Shareholders to be held on Friday, May 15, 2020, at 9:00 a.m. Eastern Time The Proxy Statement and 2019 Annual Report to Shareholders are available online atwww.proxyvote.com | |||||||||

| * | We intend to hold our 2020 Annual Meeting of Shareholders in person. However, we continue to monitor the situation regarding COVID-19 (coronavirus) closely, taking into account guidance from public health authorities. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. Accordingly, we may determine that it is advisable to change the date, time, location or manner of conducting the 2020 Annual Meeting of Shareholders. In the event that we change the date, time, location or manner of conducting the 2020 Annual Meeting of Shareholders, we will announce that fact as promptly as practicable with details on how to participate and vote at such meeting. Please monitor our website at www.itt.com/investors for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the 2020 Annual Meeting of Shareholders. |

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

ITT Inc.’s Annual Meeting of Shareholders to be held on Wednesday, May 23, 2018, at 9:00 a.m. Eastern Time

The Proxy Statement and 2017 Annual Report to Shareholders are available online atwww.proxyvote.com

ITT INC.❘2020 PROXY STATEMENT 5

ITT INC. | 2018 PROXY STATEMENT 6

ITT INC. | ❘20182020 PROXY STATEMENT 76

PROXYPROXYSTATEMENT EXECUTIVE SUMMARY

This summary highlights selected information in this Proxy Statement. Please review the entire document before voting.

ANNUAL MEETING OF SHAREHOLDERS OF ITT INC.

| Date | May |

| Time | 9:00 a.m. Eastern Time |

| Location | ITT Inc., 1133 Westchester Avenue, White Plains, NY 10604 |

| Admission Information | See page |

| Voting Item | Board Voting Recommendation | Further Information (page) | |

| 1. | To elect the 11 nominees named in the Proxy Statement to ITT’s Board of Directors | FOR each nominee | 26 |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2020 | FOR | 33 |

| 3. | To conduct an advisory vote on the compensation of the Company’s named executive officers | FOR | 37 |

| 4. | To consider a shareholder proposal regarding proxy access | AGAINST | 70 |

| Voting Item | Board Voting Recommendation | Further Information (page) | |||

| 1. | To elect the 11 nominees named in the Proxy Statement to ITT’s Board of Directors | FOR each nominee | 27 | ||

| 2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2018 | FOR | 33 | ||

| 3. | To conduct an advisory vote on the compensation of the Company’s named executive officers | FOR | 36 | ||

| 4. | To approve an amendment to ITT’s Articles of Incorporation to reduce the threshold required for shareholders to call a special meeting | FOR | 69 | ||

Your vote is important. You are eligible to vote if you were a shareholder of record at the close of business on March 26, 2018.18, 2020. Even if you plan to attend the meeting, please vote as soon as possible using one of the following methods. In all cases, you should have your proxy card in hand.

|  | |||||

|  | |||||

|  |  |  | |||

| ONLINE | BY MAIL | BY PHONE | IN PERSON | |||

| Visit the website on your proxy card | Sign, date and return your proxy card in the enclosed envelope | Call the telephone number on your proxy card | Attend the Annual Meeting in White Plains, NY. See page | |||

| * | We intend to hold our 2020 Annual Meeting of Shareholders in person. However, we continue to monitor the situation regarding COVID-19 (coronavirus) closely, taking into account guidance from public health authorities. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. Accordingly, we may determine that it is advisable to change the date, time, location or manner of conducting the 2020 Annual Meeting of Shareholders. In the event that we change the date, time, location or manner of conducting the 2020 Annual Meeting of Shareholders, we will announce that fact as promptly as practicable with details on how to participate and vote at such meeting. Please monitor our website at www.itt.com/investors for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the 2020 Annual Meeting of Shareholders. |

ITT INC. | ❘20182020 PROXY STATEMENT 97

2017 PERFORMANCE2019 FISCAL HIGHLIGHTS

(Amounts reported in this section, except per share amounts, are stated in millions unless otherwise specified.)

ITT’s financialDuring 2019, we achieved strong results that reflected continued operational execution and share gain strategies in 2017 reflectkey global markets. Our results are a strong strategicreflection of our hard work and focus on optimizing execution, expanding in key end marketscreating value for our customers, while also implementing productivity improvements and deploying capital effectively to drive growth and share gains. Highlightsmaking strategic investments. The following table provides a summary of our 2017 financial results include the following:key performance indicators for 2019 with growth comparisons to 2018.

SUMMARY OF KEY PERFORMANCE INDICATORS FOR 2019

| Revenue | Orders | Segment Operating Income | Segment Operating Margin | EPS | Operating Cash Flow | |||||

| $2,846 4% Increase | $2,813 3% Decrease | $432 5% Increase | 15.2% 20bp Increase | $3.65 3% Decrease | $358 4% Decrease |

| Adjusted Segment Operating Income | Adjusted Segment Operating Margin | Adjusted EPS | Adjusted Free Cash Flow | |||||||

| $2,868 4% Increase | $2,842 2% Decrease | $457 10% Increase | 16.0% 90bp Increase | $3.81 18% Increase | $319 95% Conversion |

Organic revenue, organic orders, adjusted segment operating income, adjusted EPS, adjusted free cash flow and adjusted free cash flow conversion are financial measures not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which are referred to as non-GAAP financial measures. Please refer to the section titled “Key Performance Indicators and Non-GAAP Financial Measures” in our 2019 Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2020 for the definition of these non-GAAP financial measures, the reasons why we use these measures and for reconciliations to the most directly comparable measures calculated in accordance with GAAP.

Our 2019 results include:

| ■ | |

| gas grew 7%, and transportation grew 3%. | |

| ■ | |

| in rail was partially offset by significant prior year defense programs. | |

| ■ | |

| growth in rail, as well as continued manufacturing and supply chain productivity, cost containment actions, and strategic acquisition benefits. These gains were partially offset by higher commodity costs and tariffs as well as unfavorable foreign exchange. | |

| ■ | |

| a favorable tax rate. | |

| ■ | Operating cash flow of $357.7 decreased $14.1 or 3.8%, primarily due to proceeds of $19.0 received in 2018 from an environmental insurance-related settlement and unfavorable working capital, |

Our Nominating and Governance Committee maintains an active and engaged Board, whose diverse skill sets benefit from both the industry and company-specific knowledge of our longer-tenured directors, as well as the fresh perspectives brought by our newer directors. We continually review our Board’s composition with a focus on refreshing necessary skill sets as our business strategy and industry dynamics evolve.

|

| |||||||||

|

| |||||||||

|

| |||||||||

|

|

ITT INC. | ❘20182020 PROXY STATEMENT 108

|

| |||||||||

| ||||||||||

|

| |||||||||

|

| |||||||||

|

| |||||||||

|

| |||||||||

|

|

Audit: Audit Committee

Compensation: Compensation and Personnel Committee

Governance: Nominating and Governance Committee

ITT INC. | 2018 PROXY STATEMENT 11

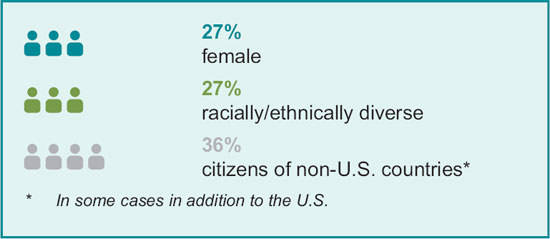

SNAPSHOT OF 20182020 DIRECTOR NOMINEES

As a whole, our director nominees possess a variety of important qualifications, skills and attributes, including those set forth in the chart below.below:

| DIRECTOR SNAPSHOT |

| Board Committees | |||||||

| Name | Age | Director Since | Other Public Company Boards | Position | Audit | Compensation and Personnel | Nominating and Governance |

| Orlando D. Ashford | 51 | 2011 | 0 | President of Holland America Line |  |  | |

| Geraud Darnis | 60 | 2015 | 0 | Former President & CEO of UTC Building & Industrial Systems |  |  | |

| Donald DeFosset, Jr. | 71 | 2011 | 3 | Former Chairman, President & CEO of Walter Industries, Inc. |  |  | |

| Nicholas C. Fanandakis | 63 | 2016 | 2 | Former Executive Vice President of DowDuPont |  | ||

| Richard P. Lavinnon-executive Chairman as of 2020 Annual Meeting | 68 | 2013 | 1 | Former President & CEO of Commercial Vehicle Group, Inc. |  |  | |

| Mario Longhi | 65 | 2017 | 1 | Former President & CEO of United States Steel Corporation |  | ||

| Rebecca A. McDonald | 67 | 2013 | 0 | Former CEO of Laurus Energy, Inc. |  | ||

| Timothy H. Powers | 71 | 2015 | 1 | Former Chairman, President & CEO of Hubbell Incorporated |  |  | |

| Luca Savi | 54 | 2019 | 0 | CEO & President of ITT Inc. | |||

| Cheryl L. Shavers | 66 | 2018 | 1 | Chairman & CEO of Global Smarts, Inc. |  | ||

| Sabrina Soussan | 50 | 2018 | 1 | CEO of Siemens Mobility |  |

| Chair |

| * | Is a citizen of a non-U.S. country (in some cases, in addition to the U.S.) |

ITT INC.❘2020 PROXY STATEMENT 9

CORPORATE GOVERNANCE HIGHLIGHTS

We are committed to strong governance practices that protect the long-term interests of our shareholders and establish strong Board and management accountability. The “Corporate Governance and Related Matters” section beginning on page 15describes12 describes our governance framework. We have adopted key corporate governance best practices, including:

| WHAT WE DO | ||||

| Independent |   | Annual Board and committee evaluation and self-assessments | |

| Highly independent and diverse Board |   | Active Board refreshment | |

| Annual election of directors |   | Director | |

| Majority voting for uncontested director elections |   | Formal limit on outside directorships | |

| Regular executive sessions of the Board and its committees |   | Meaningful stock ownership guidelines for directors | |

| Proxy access right |   | Formal director orientation and continuing education program | |

| Shareholder right to call special meetings |   | Proactive engagement with shareholders | |

ITT INC. | 2018 PROXY STATEMENT 12

| A policy prohibiting hedging and pledging of the Company’s securities |

SHAREHOLDER ENGAGEMENT AND RESPONSIVENESS

We enhancedSince formalizing our engagement with shareholdersapproach in 2017, reachingwe have reached out to shareholders representing over 50% of ITT’s outstanding shares annually to discuss governance, compensation and sustainability matters. In 2019 we built on this success and continued our robust annual shareholder engagement process, contacting shareholders representing nearly 70% of ITT’s outstanding shares outstanding, which included major asset managers, pension funds and other investors.engaging with shareholders representing over 40% of such shares. The feedback we received through these efforts was shared with our entirethe Board of Directors and members of senior management. Key themes from these conversations included corporate governance, executive compensation, and sustainability initiatives.

We engaged withThese conversations continue to inform our investors on general corporate governance matters,Board’s actions, including our approach to Board refreshment and diversity, our executive compensation programpractices, and our reporting efforts on sustainability initiatives. The feedbacktopics. For example, the Sustainability Report that we received was positive,ITT published in February 2019, and we appreciated the opportunity to discusssupplemental report that followed showing our three-year progress on environmental and get feedback on, for example, various elements ofsocial metrics, were shaped by our executive compensation design and changes that we anticipate making in 2018. We also appreciated the candid discussions relating to the topic of sustainability and where the Company’s efforts should best be focused going forward. As a result of the feedback that we received, we have made updates to a number of our to our disclosures in this Proxy Statement.with investors.

We encourage our registered shareholders to use the space provided on the proxy card to let us know your feelingsthoughts about ITT or to bring a particular matter to our attention. If you hold your shares through an intermediary or received the proxy materials electronically, please feel free to write directly to us.

EXECUTIVE COMPENSATION HIGHLIGHTS

The Compensation and Personnel Committee firmly believes in pay-for-performance and has structured the executive compensation program to align our executives’ interests with those of our shareholders.

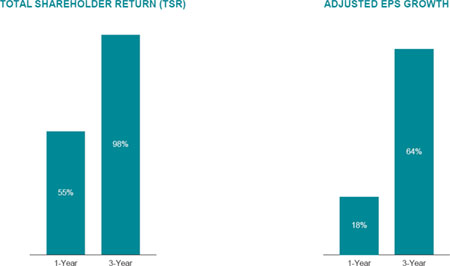

Our CEO and other Namednamed executive officers (the “Named Executive Officers (“NEOs”Officers” or “NEOs”) have a significant amount of their target pay tied to an annual bonus and long-term incentives (“LTI”), which is “Pay at Risk” and dependent on ITT’s financial performance and stock price. The following graphics illustrate 2019 CEO payout under our Annual Incentive Plan (“AIP”) and payout with respect to 2017-2019 performance stock units (“PSUs”) that were granted in 2017, before Mr. Savi became CEO.

2019 was Mr. Savi’s first year as CEO, however, his contributions in previous roles as Senior Vice President and President of Motion Technologies, and President and Chief Operating Officer of ITT, had a significant and direct impact on ITT’s performance over the past few years. The history of strong shareholder returns and adjusted EPS growth show meaningful alignment between ITT’s performance and the above target 2019 AIP and 2017 PSU award results.

See “2019 Annual Incentive Plan — 2019 AIP Performance Metrics and Weightings” for the definition of Adjusted EPS.

At ITT we believe that improving our sustainability efforts creates value for our customers, employees, communities and shareholders. It helps us align to the values and emerging expectations of today’s world. In 2019, ITT issued a sustainability report which incorporated Sustainability Accounting Standards Board (“SASB”) metrics relevant to ITT, as requested by many of our shareholders in our engagement discussions. We also publish an annual supplemental report which includes our three-year progress on key environmental, social and governance (“ESG”) metrics.

ITT INC. | ❘20182020 PROXY STATEMENT 1311

Our pay-for-performance approach is illustrated by the alignment of our CEO’s realized pay over the last two years to our three-year total shareholder return (“TSR”). In 2016, our three-year TSR (2014-2016) was -8%. In 2017, our three-year TSR (2015-2017) was +37%. Realized pay increased 38% from 2016 to 2017 due to the increase of the annual bonus payout and the payout of the 2015 performance unit award. Realized pay remains below target pay in 2017 because the stock option award that was granted in 2014 (vested in 2017) did not have any intrinsic value at the time of vesting.

Target payfor each calendar year includes: annual salary + AIP award at target payout + the grant date fair value of Long-Term Incentive (“LTI”) awards granted during the year.

Realized payfor each calendar year includes: annual salary + actual AIP payout + the intrinsic value of LTI awards that vested during the year (which were granted three years ago), calculated as of the vesting date.

ITT INC. | 2018 PROXY STATEMENT 14

CORPORATE GOVERNANCEGOVERNANCE AND RELATED MATTERS

We strive to maintain the highest standards of corporate governance and ethical conduct. Maintaining full compliance with the laws, rules and regulations that govern our business, and reporting results with accuracy and transparency, are critical to those efforts. We monitor developments in the area of corporate governance, consider the feedback of our shareholders, and review our processes and procedures in light of this input. We also review federal and state laws affecting corporate governance, as well as rules and requirements of the New York Stock Exchange (the “NYSE”). We implement other corporate governance practices that we believe are in the best interests of the Company and its shareholders.

We also understand that corporate governance practices evolve over time, and we seek to maintain practices whichthat provide the right framework for our operations whichat that time, that are of value to our shareholders and whichthat positively aid in the governance of the Company.

The following sections provide an overview of ITT’s corporate governance structure and processes, including the independence and other criteria we use in selecting director nominees, our leadership structure, and certain responsibilities and activities of the Board of Directors and its committees.

ITT’s key governance documents, including our Corporate Governance Principles (the “Principles”), and the charters for the Audit, Compensation and Personnel and Nominating and Governance Committees, are available on our website atwww.itt.com/investors/governance/corporate-governance.. Our Code of Conduct is available on our website atwww.itt.com/citizenship/code-of-conduct/www.itt.com.. We have included our website addresses only as inactive textual references and do not intend them to be active links to our website. Our website is not incorporated into or a part of this Proxy Statement. Shareholders may also obtain copies of these documents free of charge by sending a written request to ITT Inc., 1133 Westchester Avenue, White Plains, NY 10604, Attention: Corporate Secretary.

CORPORATE GOVERNANCE PRINCIPLES

The Board of Directors has adopted the Principles, which govern the operations of the Board and its committees and guide the Board and ITT’s leadership team in the execution of their responsibilities. The Nominating and Governance Committee is responsible for overseeing the Principles. The Nominating and Governance Committee reviews the Principles at least annually and makes recommendations to the Board for updates in response to changing regulatory requirements, issues raised by shareholders or other stakeholders, changing regulatory requirements or otherwise as circumstances warrant. The Board may amend, waive, suspend or repeal any of the Principles at any time, with or without public notice, as it determines necessary or appropriate in the exercise of the Board’s judgment or fiduciary duties. As noted above, we have posted the Principles on our website at:www.itt.com/investors/governance/ corporate-governance.. The Principles include the following items concerning the Board:

| ■ | no director may stand for re-election after he or she has reached the age of |

| 75; | |

| ■ | directors must be able to devote the requisite time for preparation and attendance at regularly scheduled Board and Committee meetings, as well as be able to participate in other matters necessary for good corporate governance; |

| ■ | directors are limited to service on four public company boards (including the ITT Board). If the director serves as an active CEO of a public company, the director is limited to service on |

| ■ | the CEO reports at least annually to the Board on succession planning and management development; |

| ■ | the Board evaluates the performance of the |

| ■ | the Board maintains a process whereby the Board and its committees are subject to annual evaluation and self-assessment. |

ITT INC. | ❘20182020 PROXY STATEMENT15 12

OUR BOARD LEADERSHIP STRUCTURE

Our Board does not have a formal policy with respect to the separation of the roles of Chair of the Board and Chief Executive Officer. The Board believes that this is a matter that should be discussed and determined by the Board from time to time and that each of the possible leadership structures for a board of directors has its particular advantages and disadvantages. These factors must be considered in the context of the specific circumstances, giving due consideration to the individuals involved, the culture and performance of the Company, the needs of the business, fulfillment of the duties of the Board and the best interests of shareholders.

Although the Board may determine to combine the roles of Chair and Chief Executive Officer in the future, since 2011 the Board has determined that having separate individuals holding the Chair and Chief Executive Officer positions is the right leadership structure for the Company. This structure allows our Chief Executive Officer to focus on the operations of our business while the independent Chair focuses on leading the Board in its responsibilities. The Board most recently considered the appropriate leadership structure for the Board as part of the recently completed CEO transition and, taking into account feedback from our shareholders, confirmed that this separation continues to be in the best interests of ITT’s shareholders at this time as well as for the foreseeable future.

THE BOARD’S ROLE IN LEADERSHIP SUCCESSION PLANNING

The Board is actively engaged in our talent management program. The Compensation and Personnel Committee oversees the process for succession planning for the CEO and other senior executives and updates the full Board in its executive sessions. The Board holds a formal succession planning and talent review session each summer. These sessions include the identification and development of internal candidates and assessment of key capabilities, desired leadership skills, and the ability to influence our business and strategic direction consistent with our core values. As part of the succession planning process, the CEO, working with the Board, also reviews and maintains an emergency succession plan for the position of CEO.

Directors interact with ITT leaders through Board presentations and discussions, as well as through informal events and interactions throughout the year such as lunch, dinner, and small group and planned one-on-one sessions.

As previously disclosed by the Company on December 11, 2019, the Board appointed Mr. Lavin to serve as the non-executive Chairman of the Board, effective upon his election to the Board at the Company’s 2020 Annual Meeting of Shareholders. The current Chairman of the Board, Mr. MacInnis, will continue to serve as Chairman until such time. Mr. MacInnis will not stand for re-election to the Board at the 2020 Annual Meeting of Shareholders. The appointment of Mr. Lavin to serve as the next non-executive Chairman of ITT was made in anticipation of Mr. MacInnis’ retirement and to ensure a smooth transition.

DIRECTORS’ QUALIFICATION AND SELECTION PROCESS

BOARD MEMBERSHIP CRITERIA

The Nominating and Governance Committee takes into account a variety of factorsregularly considers and reviews with the Board the appropriate skills and characteristics for Board members in fulfilling its responsibility to identify and recommend to the Board of Directors qualified candidates for membership on the Board. Directors of the Company must be persons of integrity, with significant accomplishments and recognized business stature. In addition, the

The Corporate Governance Principles state that as part of the membership criteria for new Board members, individuals mustwho are nominated are expected to have significant accomplishments and recognized business stature and possess such attributes and experiences such as are necessary to provide a broad range of personal characteristics including diversity, (with particular consideration of gender and race), management skills and business, technological and international experience, among others.experience. The Nominating and Governance Committee’s top priority is therefore ensuring that the Board is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively represent the long-term interests of shareholders.

ITT INC.❘2020 PROXY STATEMENT 13

Additional criteria for identifying and evaluating candidates for the Board include:

| ■ | personal qualities and characteristics, accomplishments and reputation in the business community; |

| ■ | current knowledge and contacts in the Company’s business communities and industries; |

| ■ | the fit of the individual’s skills and personality with those of other directors in building a Board that is effective, collegial and responsive; |

| ■ | ability and willingness to commit adequate time to Board and committee matters; |

| ■ | diversity of viewpoints, background, experience and other demographics; |

| ■ | independence (including independence from the interests of a particular group of shareholders); |

| ■ | absence of potential conflicts with our interests; and |

| ■ | such other criteria as the Board may from time to time determine relevant. |

DIRECTOR SKILLS

Our director nominees possess relevant experience, skills and qualifications which contribute to a well-functioning Board that effectively oversees the Company’s strategy and management. All of our director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have global industrial and financial expertise, public company board experience and sound business acumen.

BOARD DIVERSITY

The Board actively seeks to consider diverse candidates for membership on the Board when it has a vacancy to fill and includes diversity as a specific factor when conducting any search for candidates. In identifying and evaluating candidates for the Board, the Nominating and Governance Committee considers the diversity of the Board, including diversity of skills, experience and backgrounds, as well as ethnic and gender diversity. We believe that our Board nominees appropriately reflect a diversity of skills, of professional, gender, ethnic and personal backgrounds, and of experience.

BOARD TENURE

The Board also strives to maintain an appropriate balance of tenure and turnover among directors. The Board believes that there are significant benefits from the valuable experience and familiarity with the Company and its people and processes that longer-tenured directors bring, as well as significant benefits from the fresh perspective and ideas brought by new directors. We believe that our Board strikes the right balance of longer serving and newer directors.

PROCESS FOR IDENTIFYING AND SELECTING NEW BOARD MEMBERS

The Nominating and Governance Committee identifies director candidates through a variety of sources including an independent search firm, personal references, and business contacts.

Shareholders who wish to recommend candidates may contact the Nominating and Governance Committee in the manner described in “Communication with the Board of Directors.” Shareholder nominations must be made according to the procedures required by our Amended and Restated By-laws (the “By-laws”) and described in this Proxy Statement under the heading “Information about the Proxy Statement & Voting.” Shareholder recommended candidates and shareholder nominees whose nominations comply with these procedures and who meet the criteria referred to above will be evaluated by the Nominating and Governance Committee in the same manner as other nominees.

ITT INC.❘2020 PROXY STATEMENT 14

A key component to the nomination (and re-nomination) process is the Nominating and Governance Committee’s consideration of the results of the Board’s evaluation process. The results generated from this evaluation process include nominee attributes and experiences that will individually and collectively complement the existing Board, taking into account the Company’s mandatory retirement age, the current Board’s needs for expertise and recognizing that the Company’s businesses and operations are diverse and global in nature.

The Board strives to maintain an appropriate balance of tenure, turnover, diversity and skills among directors. The Board believes that there are significant benefits from the valuable experience and familiarity with the Company and its people and processes that longer-tenured directors bring, as well as significant benefits from the fresh perspective and ideas brought by new directors. Since the beginning of 2013, we have added six new independent directors who have brought valuable and varied experiences to our Board.

The Nominating and Governance Committee identifies director candidates through a variety of sources including an independent search firm, personal references, business contacts and our shareholders. Shareholders who wish to recommend candidates may contact the Nominating and Governance Committee in the manner described in “Communication with the Board of Directors.” Shareholder nominations must be made according to the procedures required by our Amended and Restated By-laws (the “By-Laws”) and described in this Proxy Statement under the heading “Information about the Proxy Statement & Voting.” Shareholder-recommended candidates and shareholder nominees whose nominations comply with these procedures and nominees who meet the criteria referred to above will be evaluated by the Nominating and Governance Committee in the same manner as other nominees.

Prior to recommending nominees for election as directors, the Nominating and Governance Committee, and then the full Board of Directors, engages in a deliberative evaluative process and considers the following to ensure that eachthe nominee possesses the skills and attributes that individually and collectively will contribute to an effective boardBoard of directors. Directors:

| ■ | the nominee’s fit with the membership criteria discussed above; |

| ■ | the nominee’s skills and attributes and overall complement to the skills matrix discussed above; and |

| ■ | the diversity that the nominee will add to the Board. |

Biographical information for each candidate for election as a director is evaluated and candidates for election participate in interviews with existing Board members and management. Each candidate is subject to thorough background checks and nominees must meet the requirements of the Company’s By-laws and the Corporate Governance Principles. Director nominees must be willing to commit the requisite time for preparation and attendance at regularly scheduled Board and committee meetings and participation in other matters necessary for good corporate governance.

BOARD AND COMMITTEE EVALUATION PROCESS

We recognize the critical role that Board and committee evaluations play in ensuring the effective functioning of our Board. Our Board annually evaluates the performance of the Board and its committees. As part of the Board’s self-assessment process, directors complete questionnaires whichthat consider various topics related to Board composition, structure, effectiveness, and responsibilities, as well as the overall mix of director skills, experience, and backgrounds. As set forth in its charter, the Nominating and Governance Committee oversees the Board and committee evaluation process. Annually, the Nominating and Governance Committee reviews the questionnaires and the process and considers whether changes are recommended.

ITT INC. | 2018 PROXY STATEMENT 16

TOPICS CONSIDERED DURING THE BOARD AND COMMITTEE SELF-ASSESSMENTS INCLUDE:

| Board and Committee Operations | Board Performance | Committee Performance | |||||

| ■ | Board and committee membership, including director skills, background, expertise and diversity | ■ | Key areas of focus for the Board | ■ | Performance of committee duties under committee charters | ||

| ■ | Committee structure and process, including keeping the full Board abreast of committee matters | �� | ■ | Oversight of the Company’s strategy | ■ | Effectiveness of management support for committees | |

| ■ | Access to management, experts and internal and external resources | ■ | Effectiveness of risk oversight | ■ | Identification of topics that should receive more attention and | ||

| ■ | Materials and information, including the quality and quantity of information received | ■ | Performance of Board | ■ | Performance of committee chairs | ||

| ■ | Conduct of meetings, including encouragement of and time allocated for candid dialogue | ||||||

The Company’s Corporate Secretary aggregates and summarizes all of the directors’ responses to the questionnaires, highlighting comments and year over yearyear-over-year trends. Responses are not attributed to specific Board or committee members to promote candor. These summaries are shared with the Board and committee members to inform their review and discussion. The Chair of the Nominating and Governance Committee, with support from the Corporate Secretary, leads a discussion of the Board and committee results at the Nominating and Governance Committee meeting as well as with the full Board. Each committee chair, with support from the Corporate Secretary, leads a discussion at their committee meeting of their individual assessments. As a result of these discussions, an action plan is created and practices are updated based on the self-assessment observations and suggestions. As an outcome of these discussions, directors share relevant feedback with management and suggest changes or areas of improvement or focus.

Following the in-person review of the results of the Board and committee self-assessments, our independent ChairmanChair has individual one-on-one discussions with each director to elicit any further information about their views on the functioning of the

ITT INC.❘2020 PROXY STATEMENT 15

Board and its committees. Feedback from those discussions is also incorporated into the overall action plan.

Examples of changes made in response to the self-assessment process over the last several years include:

| ■ | prioritizing diversity in the next director search; |

| ■ | increased Board exposure both formally and informally to key executives; |

| ■ | additional reserved time for “Board only” discussions to continue to foster openness and cohesiveness among the Board; and |

| ■ | a coordinated director education schedule to provide additional education on relevant topics as part of |

The Board of Directors has considered whether to engage an independent third party to conduct or facilitate the Board self-assessments and has to dateto-date concluded that an independent review wasis not necessary. The Board has agreed that theyit will consider this going forward on an as-needed basis.as needed.

The results of the self-assessment process in 20172019 confirmed the Board’s belief that the Board and its committees are currently operating effectively.

DIRECTOR ORIENTATION AND CONTINUING EDUCATION

As part of ITT’s director orientation program, new directors participate in one-on-one introductory meetings with members of ITT’s leadership team and other functional leaders. This director orientation familiarizes the directors with our business and strategic plans, significant financial, accounting and risk management issues, human resources matters, our compliance programs and other controls, policies, and procedures. The orientation also addresses Board procedures, our Principles and our Board committee charters. Finally, it provides directors with the opportunity to meet with our officers and other key members of senior management.

The Company endeavors to provide ongoing director education throughout the year. Our annual strategy session, where senior management presents the strategic plans for each of the businesses and the Company as a whole, is one component of that ongoing education. We aim to periodically hold the annual strategy session at an ITT facility in order to increase the Board’s understanding of the Company’s people, operations, product lines, and overall business. Our senior management also presents topics throughout the year to the Board in order to increase their understanding of the Company’s business operations, strategies, risks and opportunities.

ITT INC. | 2018 PROXY STATEMENT 17

Directors may enroll in external director continuing education programs at ITT’s expense on topics associated with a director’s service on a public company board in order to provide a forum for them to maintain their insight into leading governance practices, exchange ideas with peers, and keep current their skills and understanding of their duties as directors.

Our Board does not have a formal policy with respect to the separation of the roles of Chairman of the Board and Chief Executive Officer. The Board believes that this is a matter that should be discussed and determined by the Board from time to time and that each of the possible leadership structures for a board of directors has its particular pros and cons. These factors must be considered in the context of the specific circumstances, giving due consideration to the individuals involved, the culture and performance of the Company, the needs of the business, fulfillment of the duties of the Board and the best interests of the shareholders. Although the Board may determine to combine the roles of Chairman and Chief Executive Officer in the future, since 2011 the Board has determined that having separate individuals hold the Chairman and Chief Executive Officer positions is the right leadership structure for the Company. This structure allows our Chief Executive Officer to focus on the operations of our business while the independent Chairman focuses on leading the Board in its responsibilities.

Our Board values the views of our shareholders, and the feedback we receive from themshareholders is a key input to our corporate governance, executive compensation, and sustainability practices. This year, at the direction

ENGAGEMENT PROGRAM

Since formalizing our engagement approach in 2017, we have reached out annually to shareholders owning over 50% of our Board,ITT’s outstanding shares to discuss governance matters. In 2019, we expanded our outreach efforts to engagecover shareholders representing nearly 70% of ITT’s outstanding shares, and engaged with a broader populationshareholders representing over 40% of our shareholders on topics relating to our long-term business strategy as well as our governance practices. such shares. The feedback we received was shared with the Board and members of senior management.

We believe that it is important for the Company to have a direct line of communication with our shareholders so that the Board and management are better able to continually assess our policies and practices informed by these important perspectives.continually.

ITT INC.❘2020 PROXY STATEMENT 16

FALL 2019 ENGAGEMENT FEEDBACK

An overview of the specific areas of focus for our shareholders during these meetings is provided in the table below.below:

| Shareholder Engagement Outreach Efforts | |

| Percent of Shares Outstanding Contacted: | Percent of Shares Outstanding Engaged: |

| 50.7% | 37.0% |

| Shareholder Engagement Outreach Efforts | |

Percent of Shares Outstanding Contacted: 69% | Percent of Shares Outstanding Engaged: 43% |

| Specific Areas of Focus and Feedback | |

| Corporate Governance | Executive Compensation | Sustainability | |||||||

| Sustainability Reporting | |||||||||

| ■ | Discussed how the Board’s evaluation process and age limit support thoughtful refreshment | ■ | Shareholders understood the relevance of our compensation | ■ | |||||

| ■ | Shareholders recognized ITT’s commitment to Board diversity, including gender, race/ethnicity, age, geography, and business experience | ■ | Shareholder supported changes we made in 2019, including: (1) increasing the percentage of | ■ | Shareholders encouraged ITT to consider setting specific sustainability-related goals | ||||

| ■ | Shareholders appreciated ITT’s smooth leadership succession process, including the 2019 CEO transition and upcoming independent Chair transition | ■ | Shareholders supported the Board’s rationale for | ■ | |||||

ITT INC. | 2018 PROXY STATEMENT 18

As a result of the feedback we received, we have made a number of changes to this Proxy Statement in order to better communicate to our shareholders on these topics, including:

| ■ | ■ | Discussed the Nominating & Governance Committee’s oversight of ESG risks impacting ITT | |||

| ■ | Discussed the Compensation & Personnel Committee’s focus on cultivating an innovative, diverse and inclusive workplace that engages and energizes people |

RECENT BOARD ACTIONS

| ■ | Board Refreshment:Our approach to Board refreshment and diversity continues to be informed by our shareholders’ perspectives, and following recent additions to our Board that further enhanced our Board’s skill sets and diversity, we are implementing a |

| transition of the independent Chair role that will occur at the 2020 Annual Meeting. | |

| ■ | |

| enhance individual accountability. | |

| ■ | |

We encourage our shareholders to continue to engage with us and let us know your feelingstheir thoughts about ITT or to bring any matters to our attention that you would like to discuss.attention. Please feel free to write directly to us at ITT Inc.,1133, 1133 Westchester Avenue, White Plains, NY 10604,10604. Attention: Corporate Secretary.

ITT INC.❘2020 PROXY STATEMENT 17

BOARD AND COMMITTEE MEETINGS AND MEMBERSHIP

The Board of Directors and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. Under the Principles, directors are expected to attend all meetings of the Board and all meetings of the committees of which they are members. Members may attend by telephone or video conference, although in-person attendance at regularly scheduled meetings is strongly encouraged. The Board of Directors held nine9 meetings during the 20172019 fiscal year, and there were 1816 meetings of standing committees. All directors attended at least 75% of the aggregate of all meetings of the Board and standing committees on which they served. It is Company practice that all directors attend our annual meetings. All directors who were on the Board at that time attended our 20172019 annual meeting of shareholders either in person or telephonically.

The Board of Directors has an Audit Committee, a Compensation and Personnel Committee, and a Nominating and Governance Committee. The following table summarizes the current membership of each Committee:

| Name | Audit | Compensation and Personnel | Nominating and Governance | |||

| Orlando D. Ashford |  |  |   | |||

| Geraud Darnis |   |   | ||||

| Donald DeFosset, Jr. |   |   | ||||

| Nicholas C. Fanandakis |   | |||||

| Christina |  |  | ||||

| Richard P. Lavin |  |  |  |  | ||

| Mario Longhi |  |  | ||||

| Frank T. |   | |||||

| Rebecca A. McDonald |  |  | ||||

| Timothy H. Powers |   |   | ||||

| Luca Savi | ||||||

| Cheryl L. Shavers |  | |||||

|  |

| * | Mr. MacInnis and Ms. Gold are not standing for re-election in 2020. |

| Chair |

ITT INC.❘2020 PROXY STATEMENT 18

BOARD AND COMMITTEE ROLES IN OVERSIGHT OF RISK

The Board of Directors is charged with oversight of the Company’s risk management policies and practices with the objective of ensuring that appropriate risk management systems are employed throughout the Company. ITT faces a broad array of risks, including market, operational, strategic, legal, political, international and financial risks. The Board monitors overall corporate performance, the integrity of the Company’s financial controls and the effectiveness of its legal compliance and enterprise risk management programs, risk governance practices and risk mitigation efforts. The Board receives reports from management on risk matters in the context of the Company’s annual strategy session and strategic planning reviews, the

ITT INC. | 2018 PROXY STATEMENT 19

| BOARD OF DIRECTORS | |||

| ■ | The Board of Directors is charged with oversight of the Company’s risk management policies and practices with the objective of ensuring that appropriate risk management systems are employed throughout the Company. ITT faces a broad array of risks, including market, operational, strategic, legal, political, international, and financial risks. The Board monitors overall corporate performance, the integrity of the Company’s financial controls and the effectiveness of its legal compliance and enterprise risk management programs, risk governance practices, and risk mitigation efforts. The Board receives reports from management on risk matters in the context of the Company’s annual strategy session and strategic planning reviews, the annual operating plan and budget reviews and business reports, and other updates provided at Board meetings. | ||

annual operating plan and budget reviews and business reports and other updates provided at Board meetings.

The various Board committees also participate in oversight of the Company’s risk management efforts and report to the full Board for consideration and action when appropriate, as summarized in the table below.

Audit Committee | Compensation and Personnel Committee | ||||||||||||

| Nominating and Governance Committee | |||||||||||||

| Primary Risk Oversight | Primary Risk Oversight | Primary Risk Oversight | |||||||||||

| ■ | Oversees ITT’s policies on risk assessment and management, and oversees risks related to the Company’s financial statements, the financial reporting process, accounting matters, and other areas of significant financial risk. Also assesses risks related to legal and regulatory matters that may have a material impact on the Company’s financial | ||||||||||||

| ■ | Oversees risks related to compensation-related | ||||||||||||

| ■ | Oversees ITT’s overall risk management | ||||||||||||

The Company has established a cross-functional team of

| MANAGEMENT | |||

| ■ | The Company’s internal audit function has primary oversight responsibilities over risk management and engages with other members of management to monitor and analyze various risks. Each Board committee receives regular reports from management within the relevant expertise of that committee. For example, the Compensation and Personnel Committee reviews and assesses compensation and incentive program risks to ensure that the Company’s compensation programs encourage innovation and balance appropriate business risks and rewards without encouraging risk-taking behaviors that may have a material adverse effect on the Company, and it receives an annual report from management | ||

ITT INC.❘2020 PROXY STATEMENT 19

The charters of each of the Audit, Compensation and Personnel and Nominating and Governance Committees conform with the applicable NYSE listing standards, and each committee reviews its charter at least annually, and as regulatory developments and business circumstances warrant. Each of the committees considers revisions to theirits respective charterscharter from time to time to reflect evolving best practices. The descriptions below of the roles and responsibilities of each of the committees of the Board isare qualified by reference to the complete committee charters, which are available on our website atwww.itt.com/investors/governance/corporate-governance..

ITT INC. |2018 PROXY STATEMENT20

| Attendance | Responsibilities | |

Meetings Held in Committee Members Donald DeFosset, Jr. | Purpose: | |

The Audit Committee is primarily responsible for: | ||

■ reviewing and discussing with management and the independent auditor the annual audited and quarterly unaudited financial statements and approving those financial statements for inclusion in the Company’s public filings; | ||

■ reviewing and overseeing the Company’s selection and application of accounting principles and matters relating to the Company’s internal controls and disclosure controls and procedures; | ||

■ overseeing the Company’s compliance with legal and regulatory requirements, including reviewing the effect of regulatory and accounting initiatives on the Company’s financial statements; | ||

■ overseeing the structure and scope of the Company’s internal audit function; and | ||

■ overseeing the Company’s policies on risk assessment and management. | ||

The Audit Committee is also directly responsible for the selection and oversight of the Company’s independent registered public accounting firm, including determining the firm’s qualifications, independence, scope of responsibility and compensation. | ||

| Audit Committee Report, Page 35 | ||

The Audit Committee has established policies and procedures for the pre-approval of all services by our independent registered public accounting firm. The Audit Committee also has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received regarding accounting, internal controls and auditing matters. Additional details on the role of the Audit Committee may be found in “Ratification of the Independent Registered Public Accounting Firm (Proxy Item No. 2)” later in this Proxy Statement.

The Board of Directors has determined that each member of the Audit Committee is financially literate and independent, as defined by the rules of the SEC and the NYSE’s listing standard, as well as independent under the Principles. Although more than one member of the Audit Committee satisfies the relevant requirements, the Board of Directors has identified Timothy H. Powers as the audit committeeAudit Committee financial expert. The Board of Directors has evaluated the performance of the Audit Committee consistent with regulatory requirements.

ITT INC. |❘20182020 PROXY STATEMENT21 20

COMPENSATION AND PERSONNEL COMMITTEE

| Attendance | Responsibilities | |

Meetings Held in Committee Members Richard P. Lavin(Chair) Orlando D. Ashford Christina A. Gold (will not stand for re-election in 2020) Mario Longhi Rebecca A. McDonald | Purpose: | |

The Compensation and Personnel Committee reviews and approves the Company’s overall compensation philosophy and oversees the administration of the Company’s executive compensation and benefit programs, policies and practices. Its responsibilities also include: | ||

■establishing annual performance objectives, evaluating performance and approving individual compensation actions for the Chief Executive Officer and other executive officers; | ||

■reviewing and discussing the Company’s talent review and development process, succession planning process for executive officers (including, the CEO) and other senior | ||

■approving the Compensation Discussion and Analysis included in the Company’s annual proxy statement; | ||

| and ■reviewing and approving the Company’s peer companies and data sources for purposes of evaluating our compensation competitiveness and the mix of | ||

| Compensation and Personnel Committee Report, Page | ||

The Board of Directors has determined that each member of the Compensation and Personnel Committee is independent, as defined by the rules of the SEC and the NYSE’s listing standard, as well as independent under the Principles.Principles and Section 2.10 of the Company’s By-laws. In addition, each committee member is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934 (“Exchange Act”) and an “outside director” as defined in Section 162(m) of the Internal Revenue Code.. The Board of Directors has evaluated the performance of the Compensation and Personnel Committee consistent with regulatory requirements.

NOMINATING AND GOVERNANCE COMMITTEE

| Attendance | Responsibilities | |

Meetings Held in Committee Members Donald DeFosset, Jr.(Chair) Orlando D. Ashford Geraud Darnis Frank T. MacInnis Timothy H. Powers Cheryl L. Shavers | Purpose: | |

The Nominating and Governance Committee oversees the practices, policies and procedures of the Board and its committees. Responsibilities include: | ||

■evaluatingthe size, composition, governance and structure of the Board and the qualifications,compensation and retirement age of directors; | ||

■identifying, evaluating and proposing nominees for election to the Board; | ||

■considering the independence and possible conflicts of interest of directors and executive officers and ensuring compliance with applicable laws and NYSE listing standards; and | ||

■overseeing the Company’s overall enterprise risk management program. | ||

The Nominating and Governance Committee is | ||

| charged with ■overseeing the self-evaluations of the Board and its committees; | ||

■reviewing | ||

■reviewing material related party transactions in accordance with our Related Party Transactions Policy; and | ||

■monitoring our directors’ outside engagements and administering our director resignation procedures when there is a change in a director’s employment status. | ||

The Committee also maintains an informed status on the Company’s sustainability initiatives and on activities involving community relations and philanthropy. | ||

ITT INC. |❘20182020 PROXY STATEMENT22 21

The Board of Directors has determined that each member of the Nominating and Governance Committee is independent, as defined by the rules of the SEC and the NYSE’s listing standard, as well as independent under the Principles. The Board of Directors has evaluated the performance of the Nominating and Governance Committee consistent with regulatory requirements.

As stated above, the Nominating and Governance Committee evaluates the compensation program for the non-management directors and makes recommendations to the Board regarding their compensation. The Nominating and Governance Committee has retained Pay Governance LLC (“Pay Governance”) as an independent consultant for this purpose. Pay Governance’s responsibilities include providing market comparison data on non-management director compensation at peer companies, tracking trends in non-management director compensation practices, and advising the Nominating and Governance Committee regarding the components and levels of non-management director compensation. The Nominating and Governance Committee is not aware of any conflict of interest on the part of Pay Governance arising from these services or any other factor that would impair Pay Governance’s independence. Executive officers do not play any role in either determining or recommending non-management director compensation.

EXECUTIVE SESSIONS OF DIRECTORS

Agendas for meetings of the Board of Directors include regularly scheduled executive sessions led by the Board’s non-executive ChairmanChair for the independent directors to meet without management present. Board members have access to our employees outside of Board meetings, and the Board encourages directors to visit different Company sites and events periodically and meet with local management at those sites and events, either as part of a regularly scheduled Board meeting or otherwise.

Our directors and certain employees (including executive officers) are prohibited from hedging and speculative trading in and out of the Company’s securities, including short sales and leverage transactions, such as puts, calls, and listed and unlisted options.

We also prohibit our directors and certain employees from pledging Company securities as collateral for a loan.

The Board of Directors, through the Nominating and Governance Committee, conducts an annual review of the independence of its members. With the assistance of legal counsel to the Company, the Nominating and Governance Committee has reviewed the applicable standards for Board and committee member independence, as well as the standards established by the Principles. A summary of the answers to annual questionnaires completed by each of the directors and a report of transactions with director-affiliated entities are also made available to the Nominating and Governance Committee to enable its comprehensive independence review. On the basis of this review, the Nominating and Governance Committee has delivered a report to the full Board of Directors, and the Board has made its independence determinations based upon the committee’s report and the supporting information.

Under NYSE listing standards, an independent director must not have any material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company. The NYSE requirements pertaining to director independence also include a series of objective tests, such as the requirement that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. The Board also considers whether directors have any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The SEC has a separate independence requirement for audit committeeAudit Committee members that overlays the NYSE requirements. The NYSE also recently promulgated rules requiringrequires directors that serve on compensation committees to satisfy additional independence requirements specific to that service.

The Board of Directors has determined that Ms. RamosMr. Savi is not “independent” because of herhis employment as Chief Executive Officer and President of the Company. The Board of Directors has reviewed all relationships between the Company and each other member of the Board of Directors and has affirmatively determined that all of the members of the Board other than Ms. RamosMr. Savi are “independent” pursuant to the applicable listing standards of the NYSE. None of these directors were disqualified from “independent” status under the objective tests set forth in the NYSE standards. In assessing independence under the subjective relationships

ITT INC.❘2020 PROXY STATEMENT 22

test described above, the Board of Directors took into account the criteria for disqualification set forth in the NYSE’s objective tests, and reviewed and discussed additional information provided by each director and the Company with regard to each director’s business and personal activities as they may relate to the Company and its management. Based on the foregoing, as required by the NYSE, the Board made the subjective determination as to each of these directors that no material relationships with the Company exist and no relationships exist which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of such director. The Board also determined that the current members of the Audit Committee and of the Compensation and Personnel Committee meet the applicable SEC and NYSE listing standard independence requirements with respect to membership on such committees.

ITT INC. | 2018 PROXY STATEMENT 23

In making its independence determinations, the Board considered transactions occurring since the beginning of the Company’s 20152017 fiscal year between the Company and entities associated with the directors or members of their immediate family. All identified transactions that appear to relate to the Company and a person or entity with a known connection to a director were presented to the Board of Directors for consideration. The Board also considered in its analysis the Company’s contributions to tax-exempt organizations with respect to each of the non-management directors. In making its subjective determination that each non-management director is independent, the Board considered the transactions in the context of the NYSE objective standards, theand special standards established by the SEC for members of audit committees, and the SEC and Internal Revenue Service (the “IRS”) standards for compensation committee members.committees. In each case, the Board determined that, because of the nature of the director’s relationship with the entity and/or the amount involved in the transaction, the relationship did not impair the director’s independence. The Company did not make any contributions to any tax exempt organizations in which any non-management director serves as an executive officer within the past three fiscal years where such contributions exceeded the greater of $1 million or 2% of such organization’s consolidated gross revenues.

The Company has also adopted the ITT Code of Conduct which applies to all employees, including the Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer and, where applicable, to its non-management directors. We disclose on our website any changes or waivers from the Code of Conduct for the Company’s Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, our non-management directors and other executive officers. In addition, the Company will disclose within four business days any substantive changes in or waivers of the Code of Conduct granted to our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, or persons performing similar functions. We intend to do this by posting such information on our website as set forth above rather than by filing a Form 8-K.

8-K with the SEC.

The Company has established a confidential ethics phone line and website to respond to employees’ questions and reports of ethical concerns. Also, the Audit Committee has established a policy with procedures to receive, retain and treat complaints received by the Company regarding accounting, internal controls or auditing matters, and to allow for the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation and Personnel Committee during 20172019 or as of the date of this Proxy Statement havehas been an officer or employee of the Company and no executive officer of the Company served on the compensation committee or board of any company that employed any member of our Compensation and Personnel Committee or Board of Directors.

ITT INC.❘2020 PROXY STATEMENT 23

COMMUNICATION WITH THE BOARD OF DIRECTORS

Shareholders and other interested parties may contact any of our directors (including the non-executive Chairman)Chair), a committee of the Board, the Board’s non-management directors as a group, or the Board as a whole by writing to them c/o ITT Inc., 1133 Westchester Avenue, White Plains, NY 10604, Attention: Corporate Secretary. Communications are distributed to the Board, or to any individual director(s), as appropriate under the facts and circumstances. Junk mail, advertisements, product inquiries or complaints, resumes, spam and surveys are not forwarded to the Board. Material that is threatening, unduly hostile or similarly inappropriate will also not be forwarded, although any non-management director may request that any communications that have been excluded be made available.

ITT INC. | 2018 PROXY STATEMENT 24

POLICIES FOR APPROVING RELATED PARTY TRANSACTIONS

The Board has adopted a written Related Party Transaction Policy (the Policy”“Policy”) that addresses the reporting, review and approval or ratification of transactions with related parties. The Policy covers (but is not limited to) those related party transactions and relationships required to be disclosed under Item 404(a) of the Securities Exchange Commission’s (the “SEC”)SEC’s Regulation S-K, and applies to each director or executive officer of the Company;Company, any nominee for election as a director of the Company;Company, any security holder who is known to the Company to own of record or beneficially more than 5% of any class of the Company’s voting securities;securities, and any immediate family member of any of the foregoing persons (each, a “Related Party”).

The Company recognizes that transactions with Related Parties may involve potential or actual conflicts of interest and pose the risk that they may be, or be perceived to have been, based on considerations other than the Company’s best interests. Accordingly, as a general matter, the Company seeks to avoid such transactions. However, the Company recognizes that in some circumstances transactions between Related Parties and the Company may be incidental to the normal course of business, may provide an opportunity that is in the best interests of the Company to pursue, or that may not otherwise not be inconsistent with the best interests of the Company. In other cases it may be inefficient for the Company to pursue an alternative transaction. The Policy therefore is not designed to prohibit Related Party transactions; rather, it is designed to provide for timely internal reporting of such transactions and appropriate review, oversight and public disclosure of them. The Policy supplements the provisions of our Code of Conduct concerning potential conflict of interest situations. Under the Policy, an amendment to an arrangement that is considered a Related Party transaction is, unless clearly incidental in nature, considered a separate Related Party transaction.